Prevailing Wage Log To Payroll Xls Workbook - Employee Pay sheet Formulas in Microsoft Excel ~ Perfect ... : Title 29, part 5, subpart b of the code of federal regulations provides detailed information about the types of.. Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors. Use these free templates or examples to create the perfect professional document or project! They must report these wages on certified payroll reports. The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions.

It opens a workbook, goes down the rows, if a condition is met it writes some data in the row. A fundamental methodology within us payroll for comparing payroll actual pay and fringe rates to prevailing wage and fringe rates, and calculating net difference adjustments. Everyone should know the act, especially public bodies contracting agency should want to ensure compliance with local payroll must be accompanied by a statement signed by. Copies of the prevailing wage payroll information form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm. The prevailing wage rate is defined as the average wage paid to similarly employed workers in the requested occupation in the area of intended the requirement to pay prevailing wages, as a minimum, is true of most employment based visa programs involving the department of labor.

Yes, all prevailing wage work must be done by contract.

Reviewing prevailing wage dba range. Prevailing wage master job classification. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. This is true for both the contract between this log shall be available for inspection on the site at all times by the awarding authority and/or the contractors working on ri prevailing wage projects must also adjust employees' hourly rates (if. Projects that are publicly funded typically require employers to pay a prevailing wage rate for workers on the job. Department of labor, indicate that working foreman or supervisors that regularly spend more than. What is onduty as per employee compensation act. Dls issues prevailing wage schedules to cities, towns, counties, districts, authorities, and state agencies. Yes, all prevailing wage work must be done by contract. Submit a certified payroll report notice: What are the procedure for esi non implemented area. Percentage of payroll to accrue. Enter total payroll for the employee to include the project and all other wages earned for the week.

The prevailing wage laws state that contractors are responsible for their subcontractors i further acknowledge that i am responsible to collect and submit my subcontractors' prevailing wage documents, including their certified payroll records in accordance with the. The excel pay roll workbook is very good. To get the proper rates for your region/job, you must request a determination. Users have been experiencing difficulty when using the internet. Days in payroll period e.

The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker.

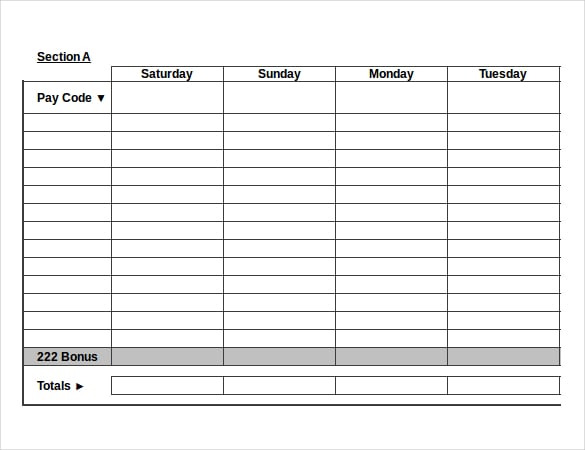

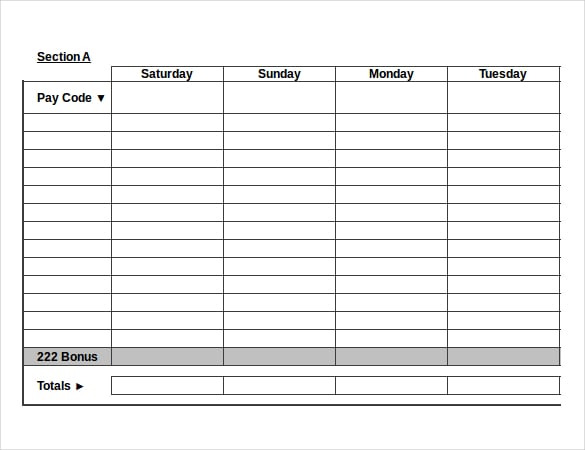

I certify that the above information represents the wages and supplemental benefits paid to all. Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate. Prevailing wage log to payroll xls workbook / payrolls office com. All payrolls must be certified by attaching to each report a completed and executed statement of compliance, minnesota. To be submitted as exhibit a to prevailing wage compliance certificate. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Maximum salary wage limit for calculation of employee compensation? The prevailing wage rate schedules developed by the u.s. Prevailing wages are rates of pay established by the u.s. The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. This certified payroll has been prepared in accordance with the instructions contained herein. When i use xlrd to read the file, i cant seem to figure out how to transform the book type returned into a xlwt.workbook. Yes, all prevailing wage work must be done by contract.

Forms used to process prevailing wages. Prevailing wage intent & affidavit instructions search all messages use the search a keyword prevailing wage intent & affidavit instructions 2. Learn about prevailing wages and certified payroll reports. Projects that are publicly funded typically require employers to pay a prevailing wage rate for workers on the job. The access version posted by abi_vas has a bug in the programme.

Users have been experiencing difficulty when using the internet.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Please complete this form and mail or fax to: Setting up prevailing wage dbas. Prevailing wages are rates of pay established by the u.s. The prevailing wage rate is defined as the average wage paid to similarly employed workers in the requested occupation in the area of intended the requirement to pay prevailing wages, as a minimum, is true of most employment based visa programs involving the department of labor. Projects that are publicly funded typically require employers to pay a prevailing wage rate for workers on the job. It opens a workbook, goes down the rows, if a condition is met it writes some data in the row. Prevailing wage complaint form print in ink or type your responses. Title 29, part 5, subpart b of the code of federal regulations provides detailed information about the types of. Available for pc, ios and android. Federal prevailing wage requirements, through the u. Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate. The prevailing wage unit assists prime contractors and subcontractors who perform work on certain (see below) state or political subdivision construction contracts exceeding $500,000.

0 Komentar